The Hottest Metal in the World Right Now – Vanadium

One of the trendiest metals on the tip of investors’ tongues right now is #vanadium.

The metal is named after Vanadis, a Norse goddess. Vanadium is very ductile, malleable and corrosion-resistant.

It’s rare for vanadium to exist as a free element and it’s usually found in minerals such as vanadinite, carnotite and magnetite. Thus, metallurgy is the key question when you find a large amount of vanadium.

Vanadium has incredible properties which increase the strength of alloys containing it, such as rebar which is heavily used in construction. China has just raised their steel rebar limits (raised the bar—no pun intended). Vanadium is also used in everything from jet engines to dental implants.

This past weekend I was down at the Katusa/Cambridge House Gold and Silver Summit in San Francisco. The main theme was precious metals, but I couldn’t escape questions about vanadium.

Here’s why…

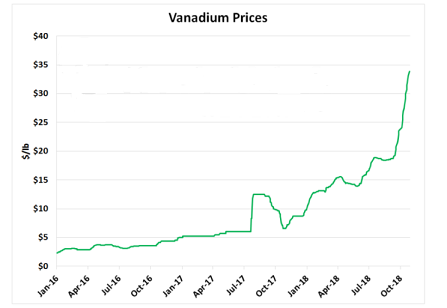

Below is a chart which shows the price of vanadium over the past 3 years.

I’ve seen this type of small sector hype many times before. And so have you with lithium and cobalt.

Like those two niche metals, many “vanadium” stocks have spiked in price, returning doubles and triples in a short time. And some have even become 5 baggers in the month of October alone. Those kinds of gains are enough to hit everyone’s radar screens. Traders, investors and “me-too” companies alike will start piling on the momentum train.

Here’s what you need to know about Vanadium

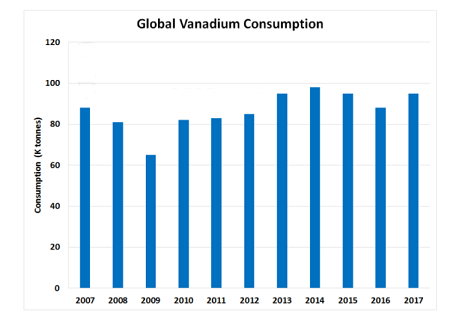

Vanadium is a small, niche sector. In 2017, global consumption was roughly 95,000 tonnes (209 million pounds).

For comparison, in 2017 the world consumed roughly 23 million tonnes of copper (50 billion pounds). Below is a chart which shows annual vanadium consumption since 2007.

Vanadium is mainly used as a stiffening agent in steel. Around 90% of annual vanadium production is sold to the steel sector. This makes the 2 industries highly correlated.

The majority of vanadium production comes from 4 countries: China, Russia, South Africa and Brazil.

So why is everyone getting excited?

There are a few reasons why the vanadium sector has been exploding.

Vanadium Excitement Reason #1: Steel demand and changes to Chinese building codes

The steel sector itself is correlated to the health and strength of economies around the world.

As economies expand and develop they need vast amounts of new infrastructure. A lot of this infrastructure requires steel, which in turn requires vanadium.

Building codes in China are edging closer towards building codes in places like the U.S. and Europe.

For example, in the U.S., you’ll find steel has about 0.1 kilograms of vanadium (3.4 ounces) per tonne of steel. Whereas in China, you’d find a tonne of steel contains about 0.05 kilograms (1.7 ounces) of vanadium.

One of the main catalysts that spiked interest in the metal is new steel regulations that China will be imposing in November 2018.

The new Chinese regulations are phasing out Grade 2 rebar which uses no vanadium in favour of grades 3, 4 and 5. Each of these new rebar grades requires vanadium. The higher the grade, the more vanadium that is required.

Vanadium Excitement Reason #2: Utility scale battery storage

Renewable energy projects are springing up around the globe.

But the biggest issue with renewable power is that it is intermittent.

You can’t generate much in the way of solar electricity in the middle of the night. That’s why battery storage is so crucial to large scale renewable power. Think oil production before pipelines and rail takeaway. This is going to happen and will be a major game changer for electricity generation dynamics.

Vanadium flow batteries are now being pilot tested as a solution to industrial scale battery storage issues. But it is still very early stage.

If vanadium flow batteries do become a go to metal for utility size energy storage, it would open up a huge amount of new demand for vanadium.

Dirty Secrets in the Vanadium Sector

Just because the vanadium sector is small, doesn’t mean that vanadium is rare.

Vanadium is actually fairly common, and can be found as a secondary metal in many types of deposits.

Most of these secondary deposits contain low grade vanadium mineralization. But at current vanadium prices, those marginal deposits become economic. Which opens up a plethora of new potential supply. This is very similar to the crappy/low grade copper and nickel projects which magically turned into cobalt projects last year.

You will see many crappy uranium projects now be touted as vanadium stories. It’s neither cheap nor easy to produce a radioactive material. Buyer beware.

The second dirty secret is that there is actually a sizable amount of production capacity which is currently offline.

Total production capacity in the vanadium market is around 150-160 thousand tonnes per year. But right now, production is only around 95,000 tonnes.

A large amount of vanadium is produced through Chinese co-production facilities, which produce both steel and vanadium. Some of these facilities are currently shutdown or operating at lower capacity rates.

It’s no secret China has a huge pollution problem. To curb some of these effects the government has forced the closure of several large steel and vanadium facilities.

You may like

Related articles And Qustion

Lastest Price from Vanadium manufacturers

US $0.00/kg2022-09-21

- CAS:

- 7440-62-2

- Min. Order:

- 1kg

- Purity:

- 99%

- Supply Ability:

- 1000kg

US $10.00/KG2022-06-02

- CAS:

- 7440-62-2

- Min. Order:

- 1KG

- Purity:

- 99%

- Supply Ability:

- 20 tons